What Is Morning Star Candlestick Pattern? How To Use In Trading How

Morning Star Candlestick Pattern This page provides a list of stocks where a specific Candlestick pattern has been detected. If you are viewing Flipcharts of any of the Candlestick patterns page, we recommend you use the Close-to-Close or Hollow Candlesticks as the bar type, and always use a Daily chart aggregation.

What Is Morning Star Candlestick? Formation & Uses ELM

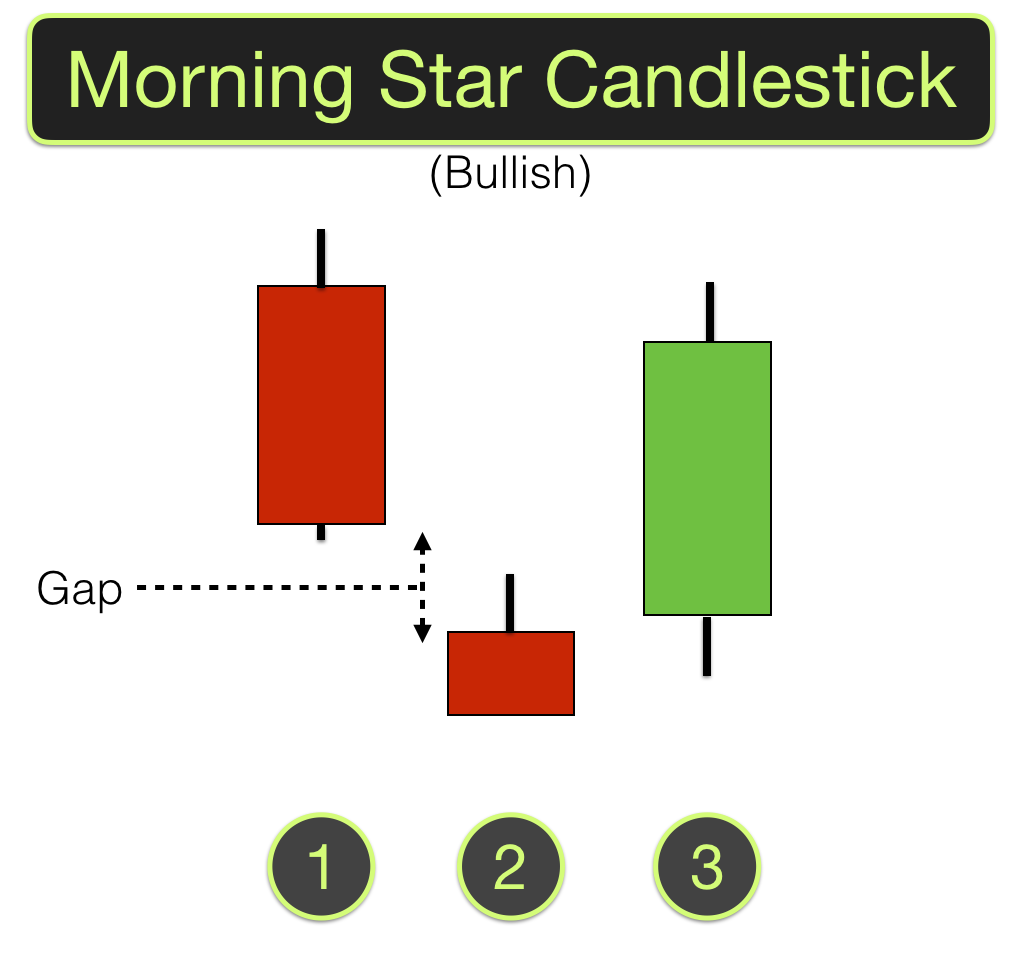

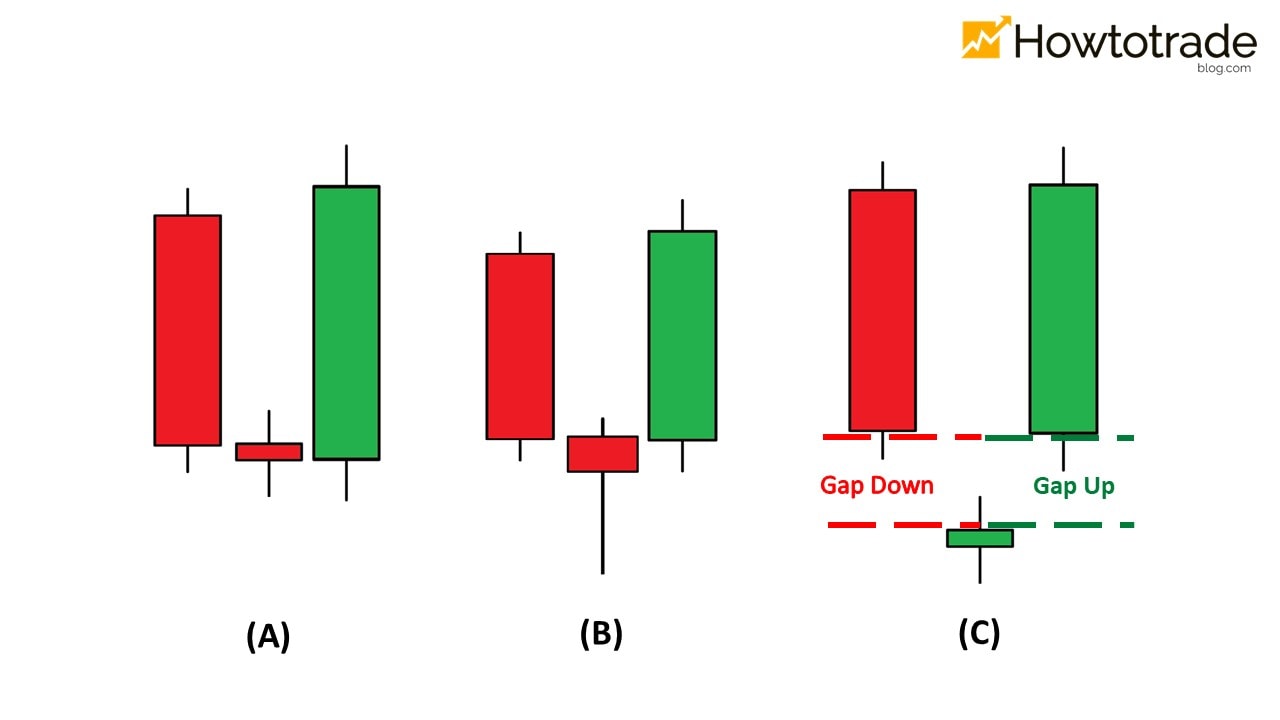

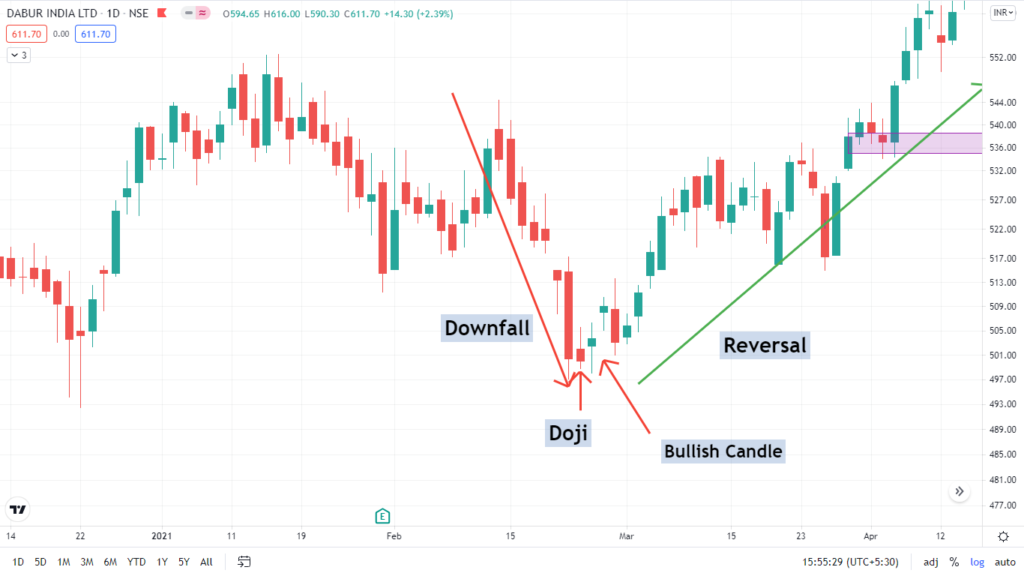

The morning star candlestick appears circled in red on the daily scale. This one is in a downward price trend when the stock creates a tall black candle. The next day, a small bodied candle (the "star") gaps below the prior body. The following day a tall white candle signals the reversal of the downtrend when its body gaps above the star's body.

What Is Morning Star Candlestick Pattern? How To Use In Trading How

634 likes, 5 comments - trading.tapri on January 9, 2024: "The morning star candlestick pattern . . @trading.tapri . . . . . #stocks #stockmarke."

145 CANDLESTICK PATTERNS PAGE 9 (17) Morning Star ( Bullish

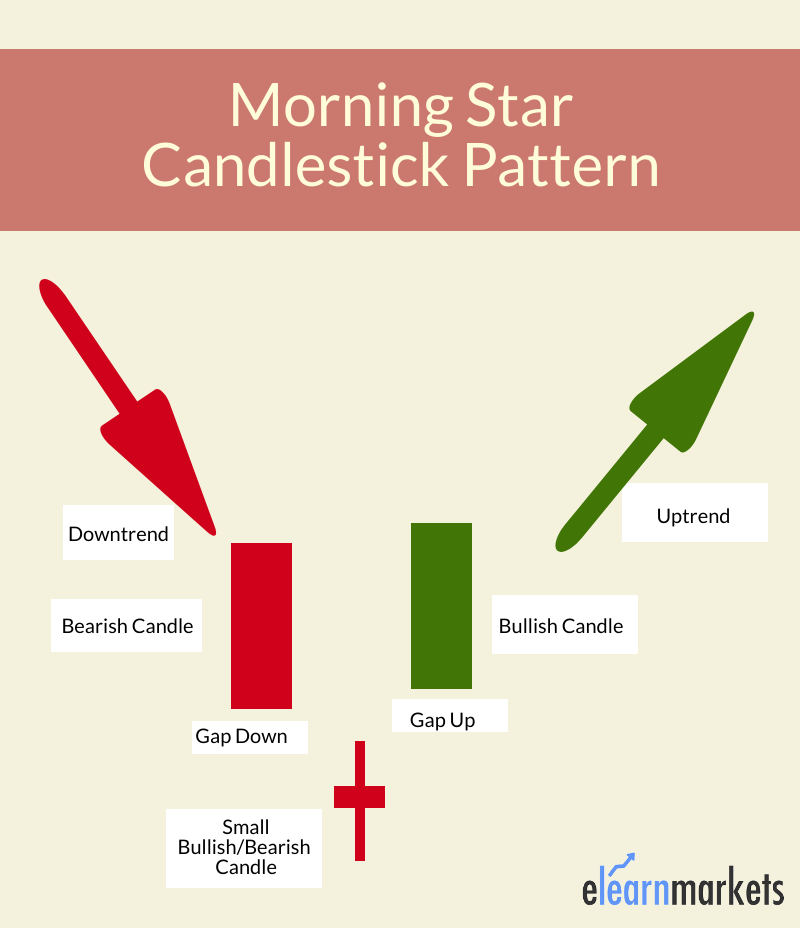

A Morning Star candlestick pattern is a reversal pattern that forms after a downtrend. The pattern has three candles: the first candle is a long red (or bearish) candle, followed by a small real-body white (or bullish) candle that gaps above the previous day's close.

Morning Star & Evening Star Candlesticks

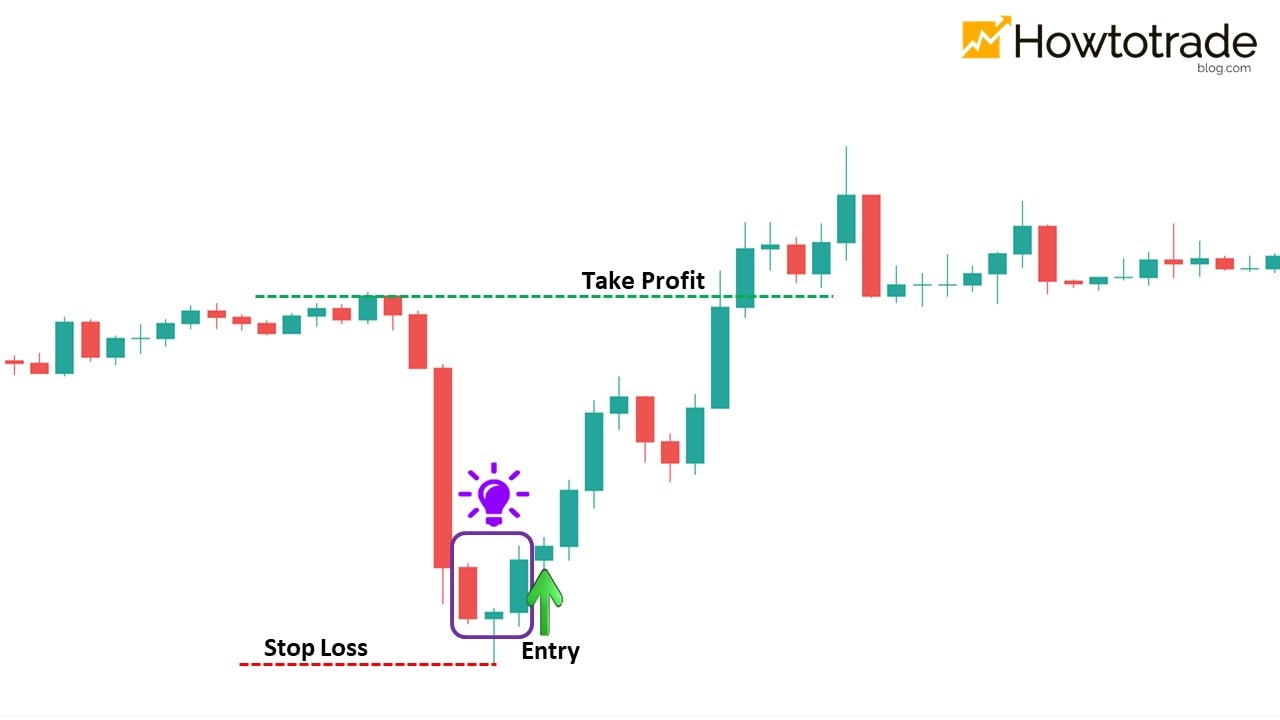

The typical method to trade a morning star is to open a buy position once you have confirmed that a bull run is actually underway. If you don't confirm the move before trading, then there's a chance the pattern could fail. If a morning star fails, then no uptrend will form, and your trade would earn a loss. There are two main ways to.

Morning Star candlestick pattern How to identify and trade it in IQ

A morning star is a visual pattern consisting of three candlesticks that are interpreted as a bullish sign by technical analysts. A morning star forms following a downward trend and it.

How To Trade Blog Morning Star Candlestick Pattern How To Trade and

A morning star is a three candle reversal candlestick pattern that forms after a downtrend. The first candle is bearish and followed by a doji that gaps down. The third candle gaps up and finishes as a big, positive candle. In this article, we're going to have a closer look at the morning star candlestick pattern.

Best candlestick patterns morning star candlestick pattern

A morning star is a visual pattern made up of a tall black candlestick, a smaller black or white candlestick with a short body and long wicks, and a third tall white candlestick. The middle.

Understanding The Morning Star Candlestick Pattern InvestoPower

What is a Morning Star Candlestick? The Morning Star pattern is a three-candle, bullish reversal candlestick pattern that appears at the bottom of a downtrend. It reveals a slowing down of.

What Is Morning Star Candlestick Pattern? How To Use In Trading How

Pasticceria da Paolo. Unclaimed. Review. Save. Share. 24 reviews #2 of 3 Desserts in Tarvisio $ Bakeries. Via delle Segherie 4, 33018 Tarvisio Italy +39 348 702 3221 + Add website + Add hours Improve this listing. See all (5) Enhance this page - Upload photos!

Morning Star Candlestick Chart Pattern 6 Strategies

The morning star consists of three candlesticks with the middle candlestick forming a star. Morning star is a powerful candlestick pattern, and most price action traders use it in their trading strategies. However, in forex trading, no pattern can guarantee you a 100% win rate.

Morning Star Candlestick Pattern Trendy Stock Charts

The Morning Star is a candlestick pattern that is comprised of three candles. A completed Morning Star formation indicates a new bullish sentiment in the market. It is considered a reversal pattern that calls for a price increase following a sustained downward trend. The Morning Star candlestick structure starts off with a relatively long red.

Morning Star Candlestick Pattern How To Trade and Win Forex With It

Strategies To Trade The Morning Star Candlestick Pattern. Strategy 1: Pullbacks On Naked Charts. Strategy 2: Trading The Morning Star With Support Levels. Strategy 3: Trading The Morning Star With Moving Averages. Strategy 4: Trading The Morning Star With RSI Divergences.

How to Trade Morning Star Candlestick Pattern Traders Ideology

The Morning Star [1] is a pattern seen in a candlestick chart, a popular type of a chart used by technical analysts to anticipate or predict price action of a security, derivative, or currency over a short period of time. Description [ edit]

Trading The Morning Star Candlestick Pattern Like A Pro! Forex Academy

A morning star is a candlestick pattern that consists of three candlesticks. A morning star is formed after a downward trend and signals the beginning of an upward movement of prices. It is a signal of a reversal in the prior price trend.

Morning Star Candlestick Pattern definition and guide

Morning Star candlestick is a bullish reversal candlestick pattern, which we can find at the bottom of a downtrend. This is one of the popular candlestick patterns used by many technical analysts. Morning Star pattern consists of three candlesticks: a big red candle, a small doji candle, and a big green candle.